02 Oct Cloud Computing Pricing Going Up, But It’s Still The Only Game In Town

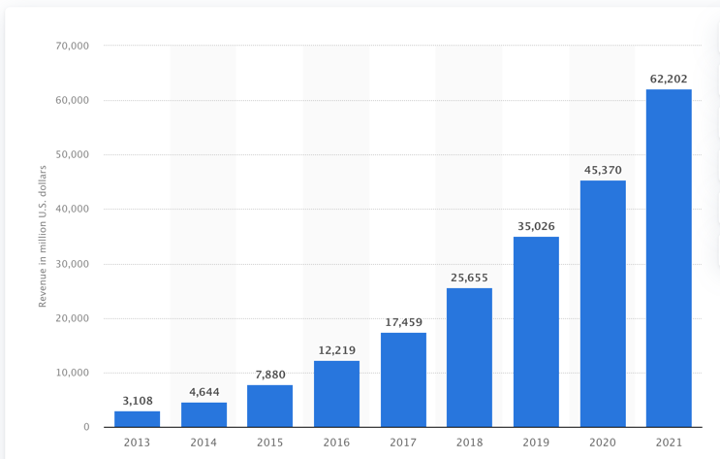

During the past decade, the cloud services industry has experienced mind-boggling growth. For example, Amazon’s AWS cloud service has experienced approximately 2000% growth in the past 8 years. Microsoft and Google, who round out the big three cloud providers, have experienced similar growth rates.

AWS Cloud Revenue Growth: 2013-2021

This astronomical growth of these hyperscalers (the industry term for scalable cloud providers) has been attributed to a few factors. Among these are an industry shift from private data centers to the cloud, continuous investments in innovation, a thriving start-up environment, and increased cybersecurity regulations.

One growth factor that is often left out is the price wars. Aggressive price cutting among the hyperscalers was key in convincing enterprises and startups to shift their IT budgets from capital expenditures (capex) to operating expenses (opex). Low prices were also key in allowing SMBs to utilize advanced IT and cybersecurity features. Last but not least, low inflation rates have helped keep prices low for the better part of the decade.

Fast forward to 2022, and we have already started seeing high inflation, supply-chain issues, and a nose-diving stock market create upward price pressures in cloud services. The year started with Microsoft increasing prices on its Microsoft 365 services by up to 20%. In 2022, S&P predicts (https://www.spglobal.com/marketintelligence/en/news-insights/research/major-cloud-providers-and-customers-face-cost-and-pricing-headwinds ) continued increased pricing among the hyperscalers.

Unfortunately, SMBs should expect significant price increases from both cloud providers and from software vendors that rely on them to deliver their products. The good news is that even as prices increase, the pace of innovation in cloud services over the past decade means that these services will continue to be an incredible value for SMBs for years to come.